Quality Candidates & Better Outcomes

Matching Recruiters with the Right Candidates through Social Channels

Turn Social Posts into Warm Leads

How it Works

Share your Post on a Social Channel

Gain Insights into Talent Engagement

Meet Qualified Talent

Social First Hiring

"To connect with the best people you have to go where they go, and these days that means social media"

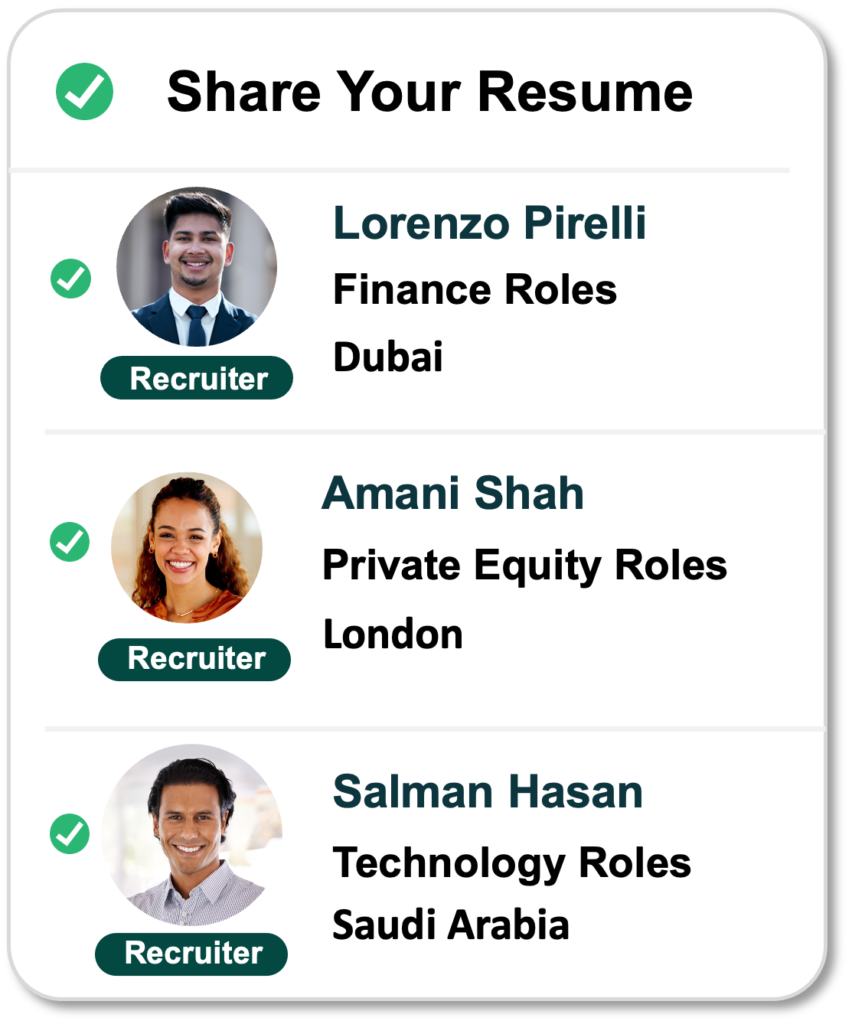

Join the Community and Match with Recruiters

Reach Multiple Decision Makers and Get Hired Faster

We help recruiters and employers in Dubai and across the Middle East attract, engage, and convert high-quality talent through social channels not just fill roles.

Instead of relying solely on job ads, Join Senna focuses on building meaningful candidate engagement across platforms like LinkedIn, helping you connect with job-ready professionals in finance, technology, consulting, and senior leadership before they enter the hiring market.

Our approach combines deep regional insight, targeted social engagement, and community-driven talent pipelines to create stronger, faster, and more reliable hires. By nurturing relationships early, we ensure every connection goes beyond a CV aligning skills, motivation, culture, and long-term potential.

Whether you’re scaling a team, hiring for a critical role, or building a future talent bench, we help you stay visible, trusted, and top-of-mind with the professionals who matter most in the Middle East’s most competitive markets.

Yes, if you have a question before you join you can contact us directly at [email protected], you can also reach us directly on linkedin https://www.linkedin.com/company/senna-iq/

Yes, because talent is far more likely to engage with direct, personalised outreach and social posts than cold inbound job board applications.